Amara Raja Energy & Mobility (ARE&M): A Sum-of-the-Parts Analysis to Uncover a Compelling Value Proposition

Executive Summary

Amara Raja Energy & Mobility Ltd. (ARE&M) presents a unique, asymmetric investment opportunity, structured as a tale of two distinct businesses. It combines a stable, cash-generating legacy Lead-Acid Battery (LAB) business with a high-growth, strategically crucial New Energy venture focused on Lithium-ion (Li-ion) technology. The current market valuation appears to be anchored to the mature LAB business, heavily discounting the transformative potential of the company's planned INR 9,500 crore investment in the Li-ion Giga Corridor. This apparent valuation disconnect creates a compelling entry point for long-term investors with significant capital.

Our Sum-of-the-Parts (SOTP) analysis indicates a fair value for ARE&M that is significantly above its current market price. We identify a "mouthwatering" accumulation range of ₹850-₹950 per share. This range offers a substantial margin of safety, reflecting a valuation that is well-supported by the legacy business alone, while providing significant upside from the New Energy venture at a minimal cost.

Key catalysts expected to unlock this value include the successful and timely commissioning of the Telangana Gigafactory's initial phases, the securing of further Original Equipment Manufacturer (OEM) contracts for Li-ion battery packs, stabilization of margins in the core LAB business, and potential inclusion in the government's Production Linked Incentive (PLI) scheme for Advanced Chemistry Cells (ACC).

The primary risks to this thesis are threefold: volatility in the prices of key raw materials such as lead and lithium; execution risks and potential delays associated with the large-scale Gigafactory capital expenditure cycle; and intense competition in the emerging Li-ion space from both established domestic and international players.

Section 1: Investment Thesis - A Tale of Two Businesses

The market's perception of Amara Raja Energy & Mobility as a traditional auto ancillary company is becoming increasingly outdated. The company is in the midst of a profound transformation, strategically leveraging its robust legacy business as a financial engine to fund its future as a leader in India's energy transition. The investment thesis hinges on the market's eventual re-rating of the stock as it recognizes the full, un-discounted value of the New Energy business.

The Legacy Engine (Lead-Acid Batteries)

The Lead-Acid Battery (LAB) division serves as the company's established cash cow. It is characterized by formidable brand equity, most notably through its "Amaron" brand, a dominant market share in key segments, and deeply entrenched relationships with major OEMs. This segment provides the financial stability and robust operating cash flow necessary to undertake ambitious, capital-intensive growth projects without resorting to significant leverage, a critical strategic advantage.

The Growth Catalyst (New Energy/Li-ion)

The New Energy segment represents the company's future and is poised to be a significant growth catalyst. The cornerstone of this strategy is the massive INR 9,500 crore investment in the "Amara Raja Giga Corridor" in Telangana. This project marks a decisive pivot towards the manufacturing of Li-ion cells and battery packs, targeting the burgeoning Electric Vehicle (EV) and Energy Storage Systems (ESS) markets. While this is a high-risk, high-reward venture, its long-term potential appears to be substantially undervalued by the market at present.

The stock has experienced a significant price correction, falling from a 52-week high of ₹1,745 to a level around ₹968, despite demonstrating strong underlying financial performance and consistent revenue growth. Concurrently, Foreign Institutional Investor (FII) holding has seen a decline, suggesting a degree of market skepticism. This market sentiment is likely driven by several perceived risks: the uncertainty surrounding the massive capex cycle for the Gigafactory, intensifying competitive pressures in the nascent Li-ion space, and persistent margin pressures from volatile raw material costs.

This pessimism, however, creates a classic value investing scenario. The market appears to be overly focused on short-term challenges, such as the capex drag on near-term free cash flow and competitive uncertainty, while underappreciating the multi-decade growth runway of the New Energy business. The company's strong, virtually debt-free balance sheet significantly mitigates the financial risk associated with this capex, with the legacy business acting as a powerful safety net. This disconnect between short-term sentiment and long-term fundamental transformation creates a valuation arbitrage. An investment at the "mouthwatering price" level essentially means an investor is being compensated to wait for the New Energy story to mature, with the stable and profitable legacy business providing a solid valuation floor.

Section 2: Corporate Deep Dive - The Amara Raja Ecosystem

A thorough understanding of Amara Raja Energy & Mobility requires looking beyond the listed entity to the broader corporate ecosystem it inhabits. This context reveals strategic advantages in branding, manufacturing, and global reach.

Evolution and Identity

The company's strategic name change from "Amara Raja Batteries Ltd." to "Amara Raja Energy & Mobility Ltd." is a critical signal of its future direction. This was not a cosmetic rebranding but a deliberate move to reflect a fundamental shift in its corporate vision. It repositions the company from being a mere component manufacturer to an integrated solutions provider at the heart of India's energy and mobility transition.

Conglomerate Structure

ARE&M is the flagship company of the Amara Raja Group, a diversified conglomerate with a reported revenue of USD 2 billion. The group's interests span a wide range of industries, including electronics manufacturing, power systems, infrastructure development, and metal fabrication. This structure provides ARE&M with invaluable access to a broad ecosystem of in-house engineering, manufacturing, and project management capabilities. Such vertical and horizontal integration is a significant competitive advantage when undertaking a project of the scale and complexity of the Giga Corridor, potentially leading to synergies and cost efficiencies that standalone competitors cannot easily replicate.

Brand Moat

The "Amaron" brand is one of the company's most powerful and underappreciated assets. It is the second-largest selling automotive battery brand in India overall and the largest-selling brand in the high-margin aftermarket segment. This brand has been built over decades on a reputation for quality and longevity, creating a deep competitive moat. This strong brand recognition and consumer trust provide significant pricing power and a loyal customer base. As ARE&M expands its portfolio into new consumer-facing energy products like home energy storage solutions, this established brand equity can be leveraged to accelerate market penetration and build customer confidence.

Global Footprint

ARE&M has a proven track record of competing on a global scale, with exports to over 60 countries. Its significant market presence in demanding international markets, such as Singapore, where it powers "Every 3rd Car," underscores its product quality and logistical capabilities. The company is actively pursuing further global expansion, with recent entries into the North American and European markets, indicating a strategic intent to diversify its geographic revenue base and compete with the best in the world.

Section 3: The Core Engine - Lead-Acid Battery (LAB) Business Analysis

While the future growth narrative is dominated by lithium-ion, the foundation of Amara Raja's current strength and future ambitions is its formidable Lead-Acid Battery (LAB) business. This segment is a market leader, a consistent cash generator, and the financial bedrock of the company.

Market Position

ARE&M holds a dominant position in the Indian battery market. It is the largest manufacturer of Valve Regulated Lead Acid (VRLA) batteries in the Indian Ocean Rim and a recognized market leader in critical industrial segments like telecom and data centers. In the automotive sector, its market share is substantial, estimated at approximately 36% for four-wheeler aftermarket batteries and around 40% for two-wheeler aftermarket batteries. This market leadership is a testament to its technological prowess, extensive distribution network, and strong brand recall.

Segmental Breakdown

The LAB business is diversified across two primary verticals:

Automotive: This segment is a major revenue driver, underpinned by strong OEM relationships with nearly every major automotive manufacturer in India, including Maruti Suzuki, Hyundai, Tata Motors, and Honda. While the OEM business ensures volume and technological relevance, the aftermarket replacement segment is the key profit center. With its powerful "Amaron" and "PowerZone" brands and a vast distribution network of over 100,000 points of sale, the company commands a significant presence in this high-margin space.

Industrial: ARE&M was a pioneer in introducing VRLA batteries to India and continues to be a preferred supplier to critical infrastructure sectors. It powers a significant portion of India's telecom towers and is a key supplier to the Uninterruptible Power Supply (UPS), railways, and defense sectors. While the telecom segment has faced temporary headwinds due to the industry's transition towards 5G and Li-ion solutions, this has been effectively offset by robust growth in the data center and UPS business, which is benefiting from the rapid digitalization of the Indian economy.

Financial Contribution

The LAB business currently accounts for the vast majority of the company's revenue, contributing over 90% of the total topline. An analysis of its historical financial performance reveals consistent profitability and strong cash flow from operations, which have been instrumental in maintaining a healthy balance sheet and funding dividends and capital expenditures without relying on external debt.

While the market's narrative is understandably focused on the disruptive potential of the EV transition, the LAB business continues to demonstrate remarkable resilience and healthy growth. Recent performance shows strong volume growth in the automotive aftermarket and industrial UPS segments. The transition to electric vehicles will be a gradual process, not an overnight switch. The existing fleet of Internal Combustion Engine (ICE) vehicles, which numbers in the hundreds of millions in India, will continue to grow for several more years. This ensures a long and predictable tail of demand for replacement batteries, which is the most profitable part of the automotive business. The company's powerful brand and extensive distribution network create a formidable moat in this aftermarket segment, one that is exceptionally difficult and costly for new entrants to replicate. Furthermore, the industrial battery business, particularly for data centers, railways, and power backup, is a stable and growing market that is largely insulated from the EV transition. Therefore, the market may be prematurely discounting the longevity and cash-generating capability of the LAB business. Its sustained resilience provides a strong valuation floor for the stock and, more importantly, a reliable source of non-dilutive capital to fund the high-stakes lithium-ion venture. This is a crucial strategic advantage over pure-play battery startups that are reliant on external funding.

Section 4: The Growth Catalyst - The New Energy & Lithium-Ion Gambit

Amara Raja's strategic pivot towards New Energy is the most critical component of its long-term investment thesis. This ambitious foray is not merely an experiment but a well-funded, methodically executed plan to establish the company as a leader in India's clean energy ecosystem.

The Amara Raja Giga Corridor (Telangana)

The centerpiece of this strategy is the Amara Raja Giga Corridor, a state-of-the-art manufacturing hub being developed in Mahbubnagar, Telangana.

Project Scope: This is a monumental undertaking with a planned capital expenditure of INR 9,500 crores phased over the next decade. The facility is designed to achieve an ultimate capacity of 16 GWh for Li-ion cell manufacturing and 5 GWh for battery pack assembly. This scale is intended to make ARE&M a globally competitive player in the battery manufacturing space.

Current Progress & Timeline: The project is advancing through a series of well-defined milestones:

The foundation stone for the project was laid in May 2023.

In a significant step, the Battery Pack Assembly Plant, with an initial capacity of 1.5 GWh, was inaugurated in August 2024. This allows the company to begin supplying finished products to OEMs immediately, using imported cells while its own cell manufacturing is under construction.

Simultaneously, the foundation stone was laid for a Customer Qualification Plant (CQP), which is expected to become operational by the first quarter of FY26. This facility is a critical de-risking element, enabling ARE&M to collaborate with customers to test, validate, and co-develop customized cell chemistries for specific applications, thereby securing future demand.

The first giga factory building for cell manufacturing is on track to commence operations by the end of calendar year 2025.

Strategic Technology & Market Alliances

Recognizing the complexities of the Li-ion market, ARE&M has forged a series of strategic partnerships to mitigate risk and accelerate its entry.

Gotion-InoBat-Batteries (GIB): In June 2024, ARE&M signed a crucial technical licensing agreement with GIB, a subsidiary of global battery giant Gotion High-Tech. This agreement provides access to Gotion's world-class and commercially proven LFP (Lithium Iron Phosphate) cell technology. This move significantly reduces R&D risk, shortens the learning curve, and accelerates the company's time-to-market with a reliable product.

OEM Partnerships: To secure initial demand, the company has signed Memorandums of Understanding (MoUs) with leading EV manufacturers Piaggio and Ather Energy. These agreements cover the development and supply of Li-ion battery packs, providing crucial offtake and market validation for its new products.

Strategic Investments: ARE&M has adopted a multi-pronged approach to technology access by making strategic investments in next-generation battery technology companies. This includes increasing its stake to approximately 9.32% in the European battery technology firm InoBat AS and investing in the Indian fast-charging battery startup Log 9 Materials. These investments provide a valuable window into emerging battery chemistries and technologies beyond LFP.

Projected Economics

Management has provided guidance on the long-term financial targets for the New Energy business. At scale (approximately 10-12 GWh of capacity), the company aims to achieve EBITDA margins of 10-11% and a Return on Equity (ROE) of 12-13%. These projections form a credible basis for long-term financial modeling and valuation of the new venture.

The company's approach to this high-stakes venture is notably methodical and de-risked. Instead of a single, monolithic investment, the Giga Corridor is being developed in phases, allowing capex to be aligned with market demand and technological advancements. The strategy to begin with pack assembly using imported cells is an intelligent market-entry tactic, enabling ARE&M to build commercial relationships and supply chains with EV OEMs before its own cell manufacturing is fully operational. The establishment of the Customer Qualification Plant is a particularly astute move, allowing for the co-development of tailored solutions for specific customer requirements, such as batteries optimized for India's demanding climatic conditions. This ensures that when the giga factory's output comes online, there is pre-validated demand waiting for it. By licensing proven technology from a global leader like Gotion, ARE&M effectively leapfrogs years of costly and uncertain internal R&D. This structured, phased, and de-risked execution strategy significantly enhances the probability of success and warrants a lower risk premium in valuation models compared to a more speculative, all-or-nothing approach.

Section 5: Financial Forensics - A Fortress Balance Sheet Underwriting Growth

A deep dive into Amara Raja Energy & Mobility's financial statements reveals a position of exceptional strength, which is the critical enabler of its ambitious growth strategy. The company's financial prudence has resulted in a fortress balance sheet, providing a significant competitive advantage.

The following table summarizes the company's consolidated financial performance over the past several fiscal years, showcasing a track record of steady growth and robust profitability.

Income Statement Analysis

ARE&M has demonstrated a consistent ability to grow its top line, with revenue expanding at a compound annual growth rate (CAGR) of approximately 11-13% over the last decade. Recent quarterly results have continued this trend, with strong revenue momentum driven by volume growth in key segments. However, profitability has faced some near-term pressure. EBITDA and PAT margins have been impacted by rising raw material costs, particularly for lead, and a temporary shift in product mix towards lower-margin traded goods. Despite these headwinds, the company has managed to maintain double-digit EBITDA margins, showcasing its operational efficiency and some degree of pricing power.

Balance Sheet Analysis

The most compelling aspect of ARE&M's financial profile is its balance sheet. The company is virtually debt-free, consistently maintaining a debt-to-equity ratio close to zero (between 0.01 and 0.04). This conservative financial policy has resulted in a formidable net worth of over ₹7,000 crore, providing a massive cushion to absorb shocks and fund growth. This pristine balance sheet is a key strategic differentiator. It allows ARE&M to fund its enormous INR 9,500 crore capex plan for the Giga Corridor primarily through internal accruals and cash on hand. This minimizes the need for costly external debt, which would burden the income statement with interest costs, and avoids equity dilution, which would harm existing shareholders. This financial independence gives the management immense flexibility and a long-term perspective that debt-laden competitors lack.

Cash Flow Analysis

The company has a strong track record of generating positive and substantial cash flow from its operations. In recent periods, the cash flow from investing has been significantly negative, which is expected given the large-scale capital expenditure on the new Giga Corridor and other capacity expansions. The key takeaway is that this investment is being managed prudently, funded by operating cash flows without straining the company's liquidity. Furthermore, ARE&M has a history of rewarding shareholders, maintaining a healthy and consistent dividend payout over the years.

Section 6: Valuation - Defining the 'Mouthwatering' Price

This section synthesizes the preceding analysis to derive a fundamentally justified valuation for Amara Raja Energy & Mobility. The objective is to move beyond simple metrics and establish a robust price range that represents a compelling, or "mouthwatering," entry point for a large-scale investment.

Valuation Methodology: Sum-of-the-Parts (SOTP) is Essential

A standard valuation approach using a single consolidated multiple, such as a Price-to-Earnings (P/E) or EV/EBITDA ratio, is inadequate for ARE&M. Such a method would conflate two businesses with vastly different characteristics: a mature, stable, low-growth legacy business and a high-growth, long-gestation, future-facing venture. This blending would mask the true underlying value of both segments.

Therefore, a Sum-of-the-Parts (SOTP) valuation is the most appropriate and rigorous methodology. This approach allows for a more nuanced analysis by valuing each business segment independently using the most suitable metric and then aggregating the results. This methodology is also employed by institutional analysts covering the company, lending it credibility.

Part 1: Valuing the Legacy Lead-Acid Battery (LAB) Business

The mature and stable LAB business is best valued using a multiple-based approach, specifically EV/EBITDA, which normalizes for differences in depreciation and capital structure.

Assumptions: We will project the FY26 EBITDA for the standalone LAB business, factoring in modest growth from the aftermarket and industrial segments. A conservative EV/EBITDA multiple in the range of 8x to 10x is applied, reflecting the business's maturity and in line with valuations for comparable stable auto ancillary companies.

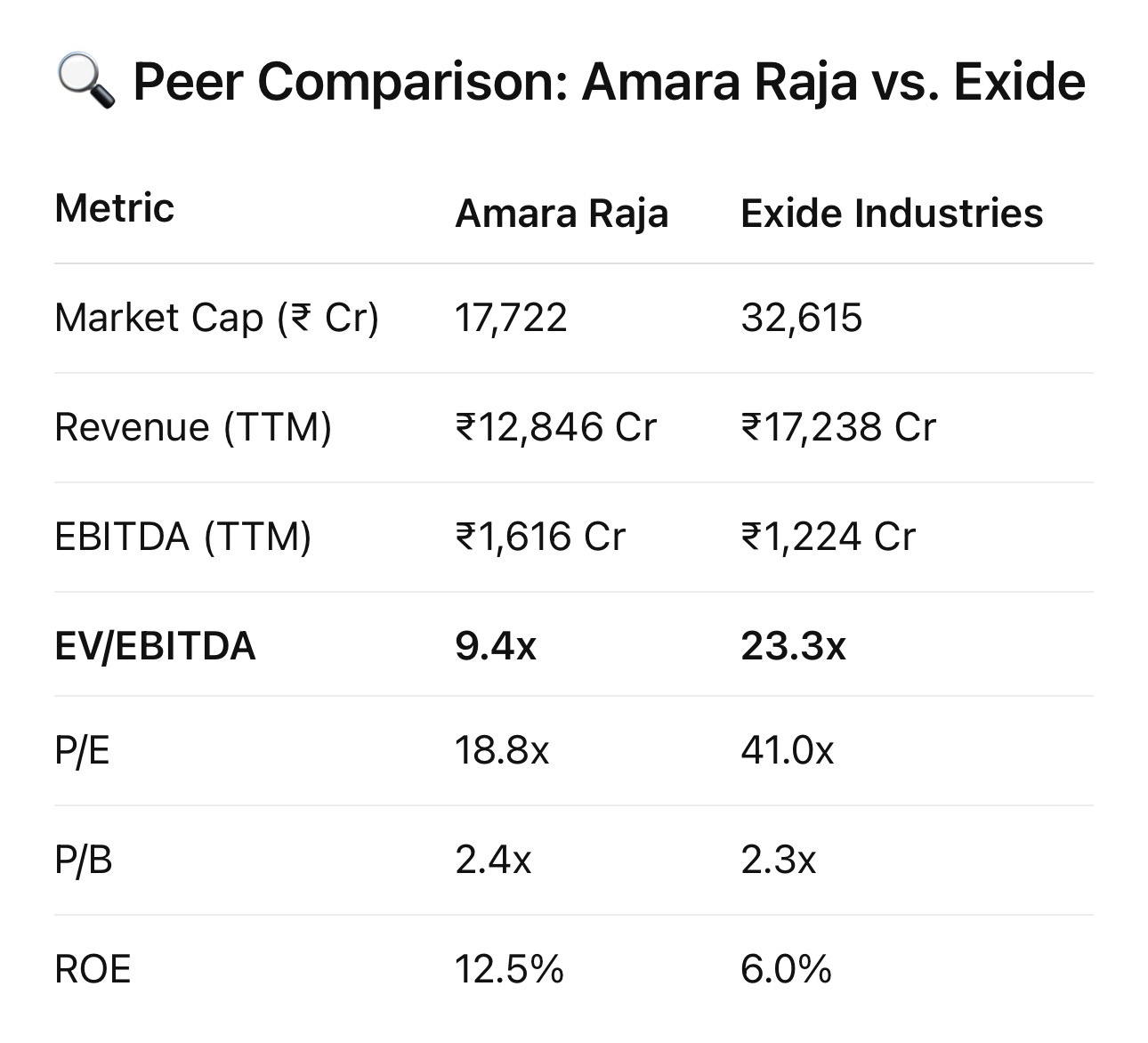

Peer Comparison: The selection of this multiple is grounded in a comparative analysis of peers in the auto ancillary and battery space.

This comparison reveals that the market assigns a significantly higher multiple to Exide, likely due to its own Li-ion ventures, and even higher multiples to growth-focused auto ancillaries like Bosch and Uno Minda. This reinforces the rationale for a conservative multiple for ARE&M's LAB business in isolation, while also highlighting the potential for a re-rating as its own New Energy business matures.

Part 2: Valuing the New Energy (Li-ion) Business (ARACT)

Valuing a nascent, high-growth business like the Amara Raja Advanced Cell Technologies (ARACT) subsidiary requires a forward-looking approach. A Discounted Cash Flow (DCF) model is the most suitable method.

Assumptions:

Revenue: A 10-year forecast period showing a gradual ramp-up of production to achieve a significant portion of the targeted 16 GWh cell capacity.

Profitability: Achieving management's guided EBITDA margins of 10-11% at scale.

Capex: Phased deployment of the total INR 9,500 crore investment over the forecast period.

Discount Rate (WACC): A higher Weighted Average Cost of Capital is used compared to the legacy business, reflecting the elevated execution and market risks of this new venture.

Terminal Value: A conservative terminal growth rate is applied, assuming the business reaches a stable growth phase post-10 years.

Cross-Check: The DCF-derived valuation is cross-referenced with external benchmarks, such as the Net Present Value (NPV) of ₹542 per share ascribed to ARACT by Anand Rathi analysts, to ensure our assumptions are within a reasonable range.

Table: Sum-of-the-Parts (SOTP) Valuation Summary

This SOTP analysis transparently breaks down the final price target, demonstrating the value contribution from each business. It clearly shows that even a conservative valuation of both segments yields a target price significantly higher than the current market price.

Scenario Analysis & The "Mouthwatering" Price

To define an attractive entry point, we consider a range of outcomes:

Base Case: The SOTP target price of ₹1,245 - ₹1,445, based on our most probable assumptions.

Bull Case: Faster-than-expected ramp-up of the Gigafactory, better-than-guided margins due to operational excellence, and securing a major global EV player as an anchor customer. This could push the valuation towards ₹1,700+.

Bear Case: Significant delays in the Giga Corridor project, major cost overruns, or intense price wars initiated by Chinese competitors leading to margin erosion. This could see the valuation fall back towards the value of the legacy business alone, around ₹800-₹900.

Based on this analysis, the "mouthwatering" price range for accumulation is identified as ₹850 - ₹950 per share. This range is derived by applying a substantial margin of safety to our base case SOTP valuation. An entry at this level implies that an investor is acquiring the highly stable, profitable, and market-leading LAB business at a fair price, while getting the immense optionality and long-term growth potential of the INR 9,500 crore New Energy venture for a very significant discount. This range also aligns with key long-term technical support levels, offering an attractive and defensible risk-reward profile for building a large position.

Section 7: Risk Matrix and Mitigation Strategies

A comprehensive investment analysis requires a rigorous assessment of potential risks and the company's strategies to mitigate them. ARE&M faces challenges inherent to its industry and its ambitious transformation, but has put credible countermeasures in place.

Raw Material Price Volatility

Risk: The profitability of the legacy LAB business is directly exposed to fluctuations in global lead prices, which can be volatile. The New Energy business introduces a new set of commodity risks, primarily a future dependence on imported lithium, cobalt, and nickel, the supply chains for which are geopolitically sensitive. A surge in these input costs could compress margins.

Mitigation: In the LAB segment, ARE&M mitigates this risk through periodic price hikes in the high-margin aftermarket segment and by entering into strategic sourcing contracts. Critically, the company is establishing a 1.5 Lac MTPA lead recycling plant. This backward integration initiative will enhance raw material security, provide a natural hedge against price volatility, and improve cost control. For the Li-ion business, the company aims to achieve 60% domestic value addition over five years and is exploring diverse sourcing strategies to reduce reliance on single geographies.

Execution Risk (Giga Corridor)

Risk: The INR 9,500 crore Giga Corridor project is a complex, multi-year undertaking. There is an inherent risk of construction delays, capital expenditure overruns, and failure to achieve projected operational efficiencies, all of which could impact returns on invested capital.

Mitigation: The company has a strong track record of executing large-scale projects. More importantly, its execution strategy is designed to de-risk the process. The phased rollout allows for capex to be aligned with market demand. The initial focus on pack assembly and the establishment of a Customer Qualification Plant are intelligent steps to build market linkages and secure offtake before committing the bulk of the cell manufacturing capex. The company's fortress balance sheet provides a strong financial buffer to withstand any unforeseen challenges during the project cycle.

Competitive & Technological Risk

Risk: The Li-ion battery space is intensely competitive, featuring established global giants like LG Chem and CATL, as well as other large Indian conglomerates making significant investments. Furthermore, battery chemistry is a rapidly evolving field, and there is a risk that the chosen LFP technology could be superseded by more advanced alternatives in the future.

Mitigation: ARE&M's technology licensing agreement with Gotion provides immediate access to a globally competitive and commercially proven LFP cell technology, allowing it to bypass years of uncertain R&D. The company is not putting all its eggs in one basket; its strategic investments in InoBat (focused on high-performance batteries) and Log 9 Materials (fast-charging technology) provide a valuable window into next-generation technologies and potential future collaborations. The Customer Qualification Plant is also designed to be adaptable, allowing for testing and validation of new chemistries as they emerge.

Regulatory Risk

Risk: The business case for the New Energy venture is influenced by government policies. Changes to EV adoption incentives (like the FAME scheme), the structure of the Production Linked Incentive (PLI) scheme, and shifts in import/export duties on cells and raw materials could impact profitability and demand.

Mitigation: The company's strategy is well-aligned with the Indian government's "Make in India" and "Aatmanirbhar Bharat" (self-reliant India) initiatives. By investing heavily in domestic manufacturing and targeting a high degree of localization (aiming for 60% domestic value addition), ARE&M positions itself as a key partner in the nation's energy security goals. This alignment makes it a strong contender for government support, including potential benefits under the PLI scheme, thereby mitigating regulatory risk.

Section 8: Leadership and Governance - A Structured Transition

The quality of leadership and the robustness of corporate governance are critical pillars for any long-term investment, especially for a company undergoing a significant strategic transformation. ARE&M demonstrates strength in both these areas.

Founder's Legacy & The "Amara Raja Way®"

The Amara Raja Group was built on a strong cultural foundation established by its founder, Dr. Ramachandra N Galla. This ethos, encapsulated in "The Amara Raja Way®," emphasizes core values of innovation, excellence, and responsibility towards all stakeholders. This values-driven culture provides a stable and ethical bedrock for the organization, which is crucial for navigating the complexities of long-term growth and maintaining investor confidence.

The Next-Generation Leadership

The company has implemented a clear and strategic succession plan, with the next generation of the founding family taking on key executive roles. A notable strength in the current leadership structure is the clear and logical division of responsibilities.

Mr. Harshavardhana Gourineni, as Executive Director for the Automotive and Industrial division, is tasked with managing and optimizing the legacy cash cow business. His focus is on maintaining market share, driving operational efficiencies, and ensuring the continued profitability of the LAB segment.

Mr. Vikramadithya Gourineni, as Executive Director for the New Energy Business, is responsible for driving the future growth engine. His mandate is to oversee the entire Li-ion strategy, from the Giga Corridor project execution to forging technology and market alliances. This demarcation ensures that both the present and the future of the company receive dedicated, high-level executive focus, preventing the legacy business from being neglected while the new venture is built. Overarching this structure is Chairman & Managing Director, Mr. Jayadev Galla, who provides strategic guidance and acts as the public face of the company, effectively leveraging his extensive political and industry network to navigate the macro environment.

Board Composition

The Board of Directors is strengthened by the inclusion of several highly qualified and experienced independent directors. Individuals such as Ms. Bhairavi Tushar Jani (logistics and supply chain), Mr. Annush Ramasamy (manufacturing and technology), Dr. Amar Patnaik (public policy, finance, and technology regulation), and Ms. Radhika Shapoorjee (corporate communications and crisis management) bring a wealth of diverse expertise to the boardroom. This diversity enhances the quality of strategic oversight, risk management, and overall corporate governance.

Shareholding Pattern

The promoter holding in ARE&M is stable at approximately 32.86%, indicating the founding family's continued commitment to the company. While FII holding has witnessed a decline in recent quarters, which may have contributed to price pressure, Domestic Institutional Investor (DII) holding has been largely supportive. A significant portion of the company's equity is held by the public and other institutions, which ensures high levels of market scrutiny, transparency, and trading liquidity.

Section 9: Actionable Guidance - Executing the 'Truckload' Investment

This final section provides a clear, actionable roadmap based on the comprehensive analysis conducted. It reiterates the investment conclusion and offers specific guidance on execution, directly addressing both parts of the initial query.

Final Recommendation

The ideal entry zone for building a large, long-term position is in the ₹850 - ₹950 range. An investment at these levels provides a significant margin of safety and a highly attractive risk-reward profile. This recommendation is made with a long-term investment horizon of at least 3-5 years, which is the time frame over which the key catalysts for the New Energy business are expected to materialize.

✍️ What to Do Next

👉 If you enjoyed this breakdown, consider subscribing to get deep-dive investment stories like this in your inbox—before the market wakes up to them.

💬 Drop a comment if you’re tracking ARE&M or have questions on battery tech, valuation, or execution strategy.

📩 Hit subscribe so you don’t miss our next hidden gem.

Disclosure: This is not investment advice. Please do your own research or consult your advisor before investing.

Works cited

1. Amara Raja Energy & Mobility Limited, https://amararajaeandm.com/ 2. Amara Raja Energy & Mobility Limited - Amaron, https://www.amaron.com/about/amara-raja 3. Amara Raja Energy & Mobility Ltd share price | About Amara Raja ..., https://www.screener.in/company/ARE&M/ 4. Amara Raja Batteries Share Price Today - Live ARE&M Stock Price ..., https://upstox.com/stocks/amara-raja-energy-mob-ltd-share-price/INE885A01032/ 5. AMARA RAJA BATTERIES 2022-23 Annual Report Analysis - Equitymaster, https://www.equitymaster.com/research-it/annual-results-analysis/AMAR/AMARA-RAJA-BATTERIES-2022-23-Annual-Report-Analysis/5062 6. Amara Raja Group - Wikipedia, https://en.wikipedia.org/wiki/Amara_Raja_Group 7. Amara Raja Energy & Mobility Limited - AWS, https://stockdiscovery.s3.amazonaws.com/insight/india/4/Investor%20Presentation/IP-Dec24.pdf 8. Amara Raja inaugurates Battery Pack Assembly Plant and lays foundation stone for Customer Qualification Plant at its Giga Corridor, https://www.amararaja.com/press_release/amara-raja-inaugurates-battery-pack-assembly-plant-and-lays-foundation-stone-for-customer-qualification-plant-at-its-giga-corridor/ 9. Amara Raja Batteries Ltd (AMARAJABAT) Share Price - Business Today, https://www.businesstoday.in/stocks/amara-raja-batteries-ltd-amarajabat-share-price-362449 10. Amara Raja Batteries Share Price (ARE&M) - INDmoney, https://www.indmoney.com/stocks/amara-raja-energy-and-mobility-ltd-share-price 11. AmaraRaja Batteries - Amara Raja Energy & Mobility Share Price - The Economic Times, https://economictimes.indiatimes.com/amara-raja-energy-mobility-ltd/stocks/companyid-12713.cms 12. Amara Raja Energy & Mobility reports 15% jump in revenue over previous year in Q4 of FY24; Board recommends a final dividend of Rs 5.10 per share, https://www.amararaja.com/press_release/amara-raja-energy-board-recommends-a-final-dividend-of-rs-5-10-per-share/ 13. Amara Raja Energy & Mobility Share Price Today 4 Jul 2025 - Mint, https://www.livemint.com/market/market-stats/stocks-amara-raja-energy-mobility-share-price-nse-bse-s0003262 14. Cost inflation and other woes drain Amara Raja Batteries' stock - Mint, https://www.livemint.com/market/mark-to-market/cost-pressures-among-other-worries-are-draining-amara-raja-batteries-stock-11629105801626.html 15. Amara Raja, http://www.dsij.in/productattachment/BrokerRecommendation/ARENM-20240531-MOSL-RU-PG012.pdf 16. Amara Raja Energy & Mobility Limited - Rating Rationale, https://www.crisil.com/mnt/winshare/Ratings/RatingList/RatingDocs/AmaraRajaEnergyAndMobilityLimited_December%2030_%202024_RR_360250.html 17. Welcome to Amara Raja Group, https://www.amararaja.com/ 18. May 29, 2025 National Stock Exchange of India Limited BSE Limited ..., https://stockdiscovery.s3.amazonaws.com/insight/india/4/Investor%20Presentation/IP-May25.pdf 19. IP_Q4FY24.pdf - Amara Raja Energy & Mobility Limited, https://www.amararajaeandm.com/Files/FinancialResults/2023/IP_Q4FY24.pdf 20. Amara Raja Energy & Mobility Share Price NSE/BSE - ARE&M Stock Price Live Today - Tickertape, https://www.tickertape.in/stocks/amara-raja-batteries-AMAR 21. AMARA RAJA ENERGY AND MOBILITY LTD. : Latest Quarterly Results Analysis, https://www.icicidirect.com/research/equity/rapid-results/amara-raja-energy-and-mobility-ltd 22. AMARA RAJA BATTERIES 2021-22 Annual Report Analysis, https://www.equitymaster.com/research-it/annual-results-analysis/AMAR/AMARA-RAJA-BATTERIES-2021-22-Annual-Report-Analysis/3323 23. Amara Raja's first giga factory set to begin operations by end of 2025, https://www.manufacturingtodayindia.com/amara-rajas-first-giga-factory-set-to-begin-operations-by-end-of-2025 24. Amara Raja's 9500 Crore Giga Factory Likely To Be Operational By 2027 - YouTube, https://www.youtube.com/watch?v=PBhzMfWU15o 25. Press Releases - Amara Raja Energy & Mobility Limited, https://www.amararajaeandm.com/media/ 26. Amara Raja Energy & Mobility Ltd - Sharekhan, https://www.sharekhan.com/MediaGalary/StockIdea/AmaraRaja-3R-Jun25_2024.pdf 27. EV Battery Market Share To Be Dominated By Core Makers, Says Amara Raja - NDTV Profit, https://www.ndtvprofit.com/business/amara-raja-says-ev-battery-market-share-to-be-dominated-by-core-makers 28. Amara Raja Energy & Mobility Ltd Results 2024 - INDmoney, https://www.indmoney.com/stocks/amara-raja-energy-and-mobility-ltd-share-price/results 29. Amara Raja Energy & Mobility Stock Price Live NSE/BSE - Groww, https://groww.in/stocks/amara-raja-batteries-ltd 30. REPORT - Amara Raja Energy & Mobility Limited, https://www.amararajaeandm.com/images/AMARA%20RAJA%20AR%202022%20FLIP%20BOOK/assets/pdf/Board-s-Report.pdf 31. Price/Book(PB) Ratio of AMARA RAJA ENERGY & MOBILITY - 28 Jun,2025, https://www.smart-investing.in/pb-ratio.php?Company=AMARA+RAJA+ENERGY+%26+MOBILITY+LTD 32. Amara Raja Energy & Mobility Ltd - Stocks - Value Research, https://www.valueresearchonline.com/stocks/40998/amara-raja-energy-mobility-ltd/ 33. Amara Raja Energy & Mobility, https://images.moneycontrol.com/static-mcnews/2024/11/20241111035732_Amara-Raja-Energy-Mobility-11112024-anand.pdf 34. NSE:ARE&M - amara raja energy mob ltd - TradingView, https://www.tradingview.com/symbols/NSE-ARE&M/ 35. Amara Raja Batteries (500008) - Technical Analysis - Mumbai S.E. - Investtech, https://www.investtech.com/main/market.php?CompanyID=91200008 36. HORIZONS - Amara Raja Energy & Mobility Limited, https://www.amararajaeandm.com/Files/AnnualGeneralMeetingFiles/2023/ARBL%20AR%202023.pdf 37. New faces will compete with Amara Raja in lithium-ion batteries for years to come: Vikramadithya Gourineni - The Economic Times, https://m.economictimes.com/markets/expert-view/new-faces-will-compete-with-amara-raja-in-lithium-ion-batteries-for-years-to-come-vikramadithya-gourineni/articleshow/100094159.cms 38. Amara Raja Group - 2025 Company Profile, Team, Competitors & Financials - Tracxn, https://tracxn.com/d/companies/amara-raja-group/__Kvr41c934XqsgZxOBn0nBddNFvKOHBnL-4Hwt9Hitzw 39. Management – Amara Raja Energy & Mobility Limited - Amaron, https://www.amaron.com/about/management 40. Founders – Welcome to Amara Raja Group, https://www.amararaja.com/leadership/founders/ 41. Leadership – Welcome to Amara Raja Group, https://www.amararaja.com/leadership/ 42. Board of Directors - Amara Raja Energy & Mobility Limited, https://www.amararajaeandm.com/LeaderShip/Board-Of-Directors 43. Executive Committee - Amara Raja Energy & Mobility Limited, https://www.amararajaeandm.com/LeaderShip/LeadershipTeam 44. Direct Equity: Personalized Investment Broking for HNIs - Equirus Wealth, https://www.equiruswealth.com/hni-broking