Orchid Pharma: An Analysis of Growth Triggers from Corporate Filings

Executive Summary

This report provides an exhaustive analysis of Orchid Pharma Limited's corporate filings over the past year to identify and evaluate potential growth triggers. Since its acquisition by the Dhanuka Group in 2020, Orchid Pharma has undergone a significant financial turnaround, creating a stable foundation for ambitious strategic initiatives. The analysis of recent exchange filings reveals a company at a pivotal juncture, transitioning from recovery to a multi-pronged growth strategy.

Four primary growth triggers have been identified, each with the potential to significantly alter the company's scale and profitability profile:

Strategic Amalgamation with Dhanuka Laboratories: The ongoing merger is the most significant corporate action, poised to create a larger, vertically integrated Cephalosporin powerhouse. The combination promises substantial synergies in manufacturing, an expanded product portfolio including non-cephalosporin APIs, and a streamlined operational structure, aligning with the management's vision of creating a Rs. 1,400-1,500 crore entity.

Monetization of the R&D Pipeline: The company's innovative capabilities are headlined by Enmetazobactam, the first India-invented New Chemical Entity (NCE) to receive both USFDA and EMA approval. This asset targets the critical Anti-Microbial Resistance (AMR) market and comes with a lucrative 6-8% global royalty structure. However, this trigger is currently clouded by significant counterparty risk, as the development partner, Allecra Therapeutics, has filed for bankruptcy, stalling royalty payments and delaying the US launch.

Backward Integration via the 7-ACA Project: A major capital expenditure of Rs. 6 billion is being directed towards a 1,000 TPA 7-ACA manufacturing plant under the government's Production-Linked Incentive (PLI) scheme. This backward integration is a tangible, long-term driver for margin expansion and supply chain de-risking.

Regulatory and Market Validation: The company's Alathur facility recently received a "Voluntary Action Indicated" (VAI) status from the USFDA, a positive outcome that clears a key regulatory hurdle for exports. This has been complemented by a noticeable increase in shareholding by institutional investors, who have absorbed the promoter's mandatory stake dilution, signaling growing market confidence in the company's strategic direction.

Despite the transformative potential of these triggers, the analysis also highlights material risks and headwinds. The outlook for the near-term (FY26) appears muted due to persistent pricing pressure in the base API business, the uncertainty surrounding Enmetazobactam royalties, and execution risks evidenced by 3-6 month delays in the 7-ACA and Cefiderocol projects.

In conclusion, the exchange filings of Orchid Pharma present a compelling, albeit back-ended, growth narrative. The triggers are credible and powerful, but their full impact is contingent on the successful resolution of external risks (Allecra bankruptcy) and internal execution of large-scale projects. The company's future growth trajectory is clearly defined, but it is one that requires a long-term investment horizon.

The Post-Insolvency Turnaround: A Foundation for Growth

The current strategic posture of Orchid Pharma cannot be understood without first appreciating the profound operational and financial turnaround executed since its acquisition by the Dhanuka Group. On March 31, 2020, Dhanuka Laboratories Limited, the pharmaceutical arm of the Dhanuka Group, acquired the debt-ridden Orchid Pharma through the Corporate Insolvency Resolution Process (CIRP). This event marked a definitive turning point, rescuing the company from insolvency and setting it on a path of revitalization. The period since the takeover has been characterized by a disciplined focus on restoring financial health and operational efficiency, which has created the necessary platform for the ambitious growth initiatives now underway.

A primary objective of the new management was to deleverage the balance sheet, a goal that was successfully achieved in 2023 when the company became debt-free. This financial cleanup is starkly evident in the company's financial statements. Total debts have been systematically reduced from Rs. 566.39 crore in March 2020 to a much more manageable Rs. 134.96 crore as of March 2024. This drastic reduction in liabilities has freed up cash flows from burdensome interest payments and provided the company with the financial flexibility to invest in future growth. The annual interest expense, which stood at a crippling Rs. 52.21 crore in FY21, fell to just Rs. 16.71 crore by FY24.

This financial stabilization has been accompanied by a robust and consistent improvement in the company's top line. Consolidated sales have shown impressive growth, rising from Rs. 450 crore in FY21 to Rs. 666 crore in FY23, and further to Rs. 819 crore in FY24. Analyst reports and quarterly results project sales to have reached Rs. 922 crore for the fiscal year ending March 2025. This translates to a strong Compound Annual Growth Rate (CAGR) of approximately 22% in sales over the last three years, a testament to the new management's focus on maximizing capacity utilization and improving sales execution.

The most compelling evidence of the turnaround lies in the company's profitability metrics. Orchid Pharma has transitioned from a significant net loss of Rs. 117 crore in FY21 to a consolidated Profit After Tax (PAT) of Rs. 94.75 crore in FY24 , with projections for FY25 PAT at Rs. 100 crore. This swing to profitability has been driven by expanding margins. The operating profit margin (OPM) has steadily improved from 7% in FY21 to 14% by FY24. Similarly, Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) have grown at a CAGR of 30% over the past three years.

This successful financial and operational revival is more than just a historical achievement; it is the essential prerequisite for the company's future growth. The demonstrated ability of the Dhanuka management to reduce debt, grow revenues, and expand margins has not only restored the company's financial health but has also built significant credibility in the market. Without this stable foundation, Orchid Pharma would lack both the internal resources and the external confidence required to pursue transformative strategies such as the amalgamation with Dhanuka Laboratories, the Rs. 6 billion capex for the 7-ACA project, or the commercialization of its R&D pipeline. The filings clearly depict a company that has successfully shifted its strategic focus from mere survival in the immediate post-CIRP period to ambitious, long-term value creation.

The Dhanuka Laboratories Amalgamation: A Strategic Consolidation

The most significant corporate action detailed in the recent filings is the proposed Scheme of Amalgamation of Dhanuka Laboratories Limited (DLL) with Orchid Pharma Limited (OPL). The Board of Directors of both companies approved the draft scheme, setting the appointed date for the merger as April 1, 2024. The process is advancing through the regulatory pathway, with the National Company Law Tribunal (NCLT) having convened meetings of equity shareholders and unsecured creditors for June 2025 to consider and approve the scheme. This merger is not merely an operational combination but a cornerstone of the management's long-term strategy to create a dominant, integrated pharmaceutical entity.

The Strategic Rationale

The rationale for the amalgamation, as detailed in the scheme documents, is multifaceted and strategically coherent. The primary objective is to create significant synergies by combining two entities operating in the similar business of manufacturing and distributing pharmaceutical products, with a shared focus on Active Pharmaceutical Ingredients (APIs). The management envisions that the merger will enable the pooling of financial, managerial, technical, and marketing resources, leading to substantial cost reductions, improved operational efficiencies, and a stronger, more consolidated market presence.

A key driver for this move is the fulfillment of the vision laid out in the original resolution plan of May 2019, which explicitly stated the intent to merge the entities post-acquisition. The goal was to create a much larger company with the potential to reach a sales turnover of Rs. 1,400-1,500 crores and an EBITDA of Rs. 200-250 crores, thereby creating a high-value company in the future. The merger is thus the logical culmination of the CIRP process, aimed at unlocking the full potential of the combined assets. The consolidation is also expected to result in a wider product portfolio and an expanded geographical footprint, enhancing the competitive positioning of the amalgamated entity.

The Combined Entity

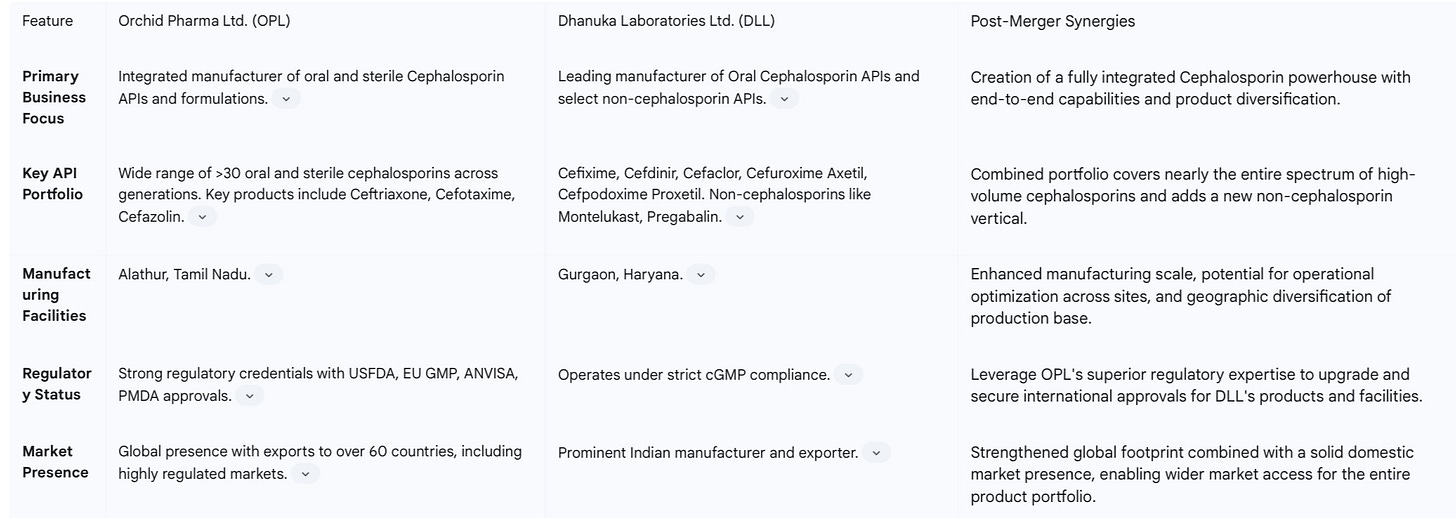

The amalgamation brings together two complementary businesses to form a more formidable player, particularly in the cephalosporin antibiotic space. Orchid Pharma's core strength lies in its wide and integrated portfolio of over 30 products across both oral and sterile cephalosporins, backed by approvals from stringent regulatory authorities like the USFDA and EU GMP. Its primary manufacturing facility is located at Alathur, Tamil Nadu.

Dhanuka Laboratories Limited, the amalgamating company, is a leading Indian manufacturer and exporter specializing in ORAL CEPHALOSPORIN APIs, operating under cGMP conditions from its facilities in Gurgaon, Haryana. DLL will contribute a robust portfolio of high-volume oral cephalosporin APIs, including Cefixime, Cefdinir, Cefaclor, Cefuroxime Axetil, and Cefpodoxime Proxetil. Crucially, DLL also brings a portfolio of non-cephalosporin APIs, such as Montelukast, Pregabalin, Rosuvastatin, and Vildagliptin. This addition provides the merged entity with valuable product diversification, reducing its historical concentration on a single class of antibiotics and opening up new therapeutic areas for growth.

The following table provides a comparative overview of the two entities, highlighting the synergies of the proposed merger.

Financial & Structural Impact

The financial and ownership structure of the merged entity will be redefined by the amalgamation. The agreed-upon share exchange ratio is 161 fully paid-up equity shares of Orchid Pharma (with a face value of Rs. 10 each) to be issued and allotted for every 5 fully paid-up equity shares of Dhanuka Laboratories (with a face value of Rs. 100 each). While the process is ongoing, analyst reports have already begun to factor in the financial impact of the merger, with most models incorporating its contribution from the second half of fiscal year 2026, suggesting a slight delay from the initial guidance.

This merger represents a clear scale and diversification strategy. It is designed to create an entity with dominant vertical depth in cephalosporins—from key starting materials (with the 7-ACA project) to APIs to formulations—and new horizontal breadth through the addition of a non-cephalosporin API portfolio. The management's explicit financial targets underscore the transformative ambition behind this consolidation, aiming to elevate the company into a significantly larger and more diversified pharmaceutical player.

Unpacking the R&D Pipeline: High Potential, High Risk

Beyond the strategic consolidation and fortification of its core business, Orchid Pharma's filings reveal a significant growth lever in its research and development pipeline. These assets, particularly the novel molecule Enmetazobactam, represent potential non-linear growth opportunities that could fundamentally re-rate the company. However, these high-reward prospects are intrinsically linked with high risks, including counterparty dependencies and execution timelines, which have become more pronounced in recent disclosures.

Enmetazobactam: The Crown Jewel and Its Complications

The centerpiece of Orchid's R&D pipeline is Enmetazobactam, a novel Beta-Lactamase inhibitor. Its development is a landmark achievement, as it is the first New Chemical Entity (NCE) invented in India by an Indian pharmaceutical company to receive approval from both the US Food and Drug Administration (USFDA) and the European Medicines Agency (EMA). When combined with the antibiotic Cefepime, the drug is indicated for treating complicated urinary tract infections (cUTI) and other severe hospital-acquired infections caused by resistant bacteria. This positions Enmetazobactam to address the critical global health threat of Anti-Microbial Resistance (AMR), a "silent pandemic" associated with millions of deaths annually.

The business model for this asset was structured through an out-licensing agreement with Allecra Therapeutics, a European biopharmaceutical company, which was tasked with further development and global commercialization. Under this agreement, Orchid Pharma is entitled to a sales-based royalty of 6-8% on worldwide sales, a potentially lucrative stream of high-margin revenue. The total addressable market for the drug has been projected to be around US$ 1 billion over a ten-year period. Furthermore, Orchid has retained the marketing rights for India and is establishing a new division, Orchid Antimicrobial Solutions (AMS), to launch and market the product domestically.

However, a major complication has emerged that casts a shadow over this promising outlook. Recent analyst reports based on company disclosures have highlighted that Orchid's partner, Allecra Therapeutics, has filed for bankruptcy. This development has had a direct and immediate negative impact on Orchid Pharma. Royalty payments, which had just begun to trickle in from the European launch, have been stalled for the past two quarters. More critically, the bankruptcy proceedings have led to a delay in the much-anticipated launch of the drug in the lucrative US market. This transforms what was a scientifically de-risked asset into one fraught with commercial and legal uncertainty. The future value of this "crown jewel" now hinges on the outcome of Allecra's bankruptcy proceedings and whether a new partner will acquire the asset and proceed with its commercialization—a resolution that is entirely outside of Orchid's direct control.

Other Pipeline Assets

While Enmetazobactam is the lead asset, Orchid's pipeline contains other valuable opportunities. The company has entered into a sub-license agreement with the Global Antibiotic Research & Development Partnership (GARDP) to manufacture and supply Cefiderocol, an antibiotic developed by the Japanese firm Shionogi. This agreement covers 135 low- and middle-income countries, including India, further strengthening Orchid's position in the AMR space. The company is investing US$ 10-15 million to establish a dedicated manufacturing facility for this product. However, similar to other projects, the timeline for Cefiderocol has seen delays, with the commercial launch now expected in the second quarter of FY27, reflecting a pushback of three to six months.

In addition to these named assets, the company continues to leverage its R&D capabilities in cephalosporins. Development is on track for Ceftaroline, another advanced cephalosporin. Furthermore, Orchid is actively working on developing a non-infringing process for a generic version of Ceftazidime/Avibactam, a high-value combination antibiotic, with the goal of an early entry into the US and EU markets.

The R&D pipeline, therefore, presents a classic high-reward, high-risk scenario. The regulatory approvals for Enmetazobactam have unequivocally validated Orchid's scientific prowess. Yet, the commercial realization of this asset's value has been abruptly halted by counterparty failure. This shifts the nature of the growth trigger from a predictable royalty stream to a more speculative, binary outcome dependent on legal and commercial negotiations. The delays in other key pipeline projects further underscore the inherent execution risks and long gestation periods associated with pharmaceutical innovation.

Fortifying the Core: The 7-ACA Backward Integration Project

In a strategic move to strengthen its core business, de-risk its supply chain, and capture greater value, Orchid Pharma is undertaking a significant capital expenditure project for the backward integration into a key starting material. This initiative, centered on the manufacturing of 7-aminocephalosporanic acid (7-ACA), is one of the most tangible and strategic growth drivers identified in the company's filings.

Strategic Importance and Financial Incentives

The project involves the establishment of a new manufacturing facility in Jammu through Orchid's wholly-owned subsidiary, Orchid Bio-Pharma Ltd. This plant will have a committed capacity to produce 1,000 tonnes per annum (TPA) of 7-ACA, a critical intermediate for the synthesis of a wide range of cephalosporin antibiotics. Currently, a substantial portion of 7-ACA is imported, primarily from China, making Indian pharmaceutical companies vulnerable to supply chain disruptions and price volatility. By manufacturing this key material in-house, Orchid aims to achieve greater control over its supply chain, ensure raw material security, and significantly enhance its profitability margins by capturing a larger part of the value chain.

This strategic initiative is further bolstered by significant government support. The project has been approved under the Indian government's Production-Linked Incentive (PLI) scheme for Key Starting Materials (KSMs). This scheme is designed to encourage domestic manufacturing of critical pharmaceutical inputs and reduce import dependency. Under the PLI scheme, Orchid will be eligible for an incentive equivalent to 20% of the sales price of its 7-ACA production. This incentive is over and above the standalone profitability of the business, which is itself expected to generate an EBITDA margin of around 10%. The total planned investment for this ambitious project is approximately Rs. 6 billion.

Execution Risk and Delays

While the strategic and financial logic of the 7-ACA project is compelling, its execution has encountered delays, a material development highlighted in recent analyst communications. The project is now reported to be facing a six-month delay, with the expected completion date pushed to December 2026. Consequently, the timeline for commercial operations and the realization of financial benefits has been shifted from FY27 to FY28.

This delay is a significant factor in assessing the company's near-to-medium-term growth trajectory. The anticipated margin expansion and revenue contribution from this major capex will not materialize as early as previously expected. This development underscores the inherent execution risks associated with large-scale greenfield projects and necessitates a longer-term perspective for investors looking to see the fruits of this investment. Unlike the external and unpredictable risks associated with the R&D pipeline, the 7-ACA project is a concrete, strategic investment in the company's core operational strength. Its successful commissioning, even if delayed, is poised to be a durable, margin-accretive growth driver that will fundamentally strengthen Orchid's competitive position in the global cephalosporin market.

Regulatory Standing and Market Confidence

In the pharmaceutical industry, growth triggers are not only generated internally through strategic initiatives but are also validated externally by regulatory bodies and the investment community. Recent filings for Orchid Pharma indicate positive developments on both fronts, providing crucial validation for the company's turnaround story and future growth strategy.

US FDA Compliance: A Key Hurdle Cleared

A significant de-risking event occurred on May 29, 2025, when Orchid Pharma announced that it had received an Establishment Inspection Report (EIR) from the United States Food and Drug Administration (USFDA) for its Active Pharmaceutical Ingredient (API) manufacturing facility located in Alathur, Tamil Nadu. The EIR was issued with a "Voluntary Action Indicated" (VAI) status.

The VAI classification is a favorable outcome. It signifies that while the FDA inspection may have resulted in some observations, they were not of a nature to warrant any regulatory or enforcement action. It confirms that the company's corrective and preventive actions submitted in response to the observations were found acceptable by the agency. This successful closure of the inspection reaffirms the Alathur plant's compliance with the USFDA's stringent cGMP (current Good Manufacturing Practices) standards. For an export-oriented API player like Orchid, this is a critical development. It clears a major regulatory overhang and ensures continued, uninterrupted access to the highly lucrative and regulated US market, which is fundamental to its base business.

Shareholding Dynamics: The "Changing of Hands"

Concurrent with the positive regulatory developments, an analysis of the company's shareholding pattern reveals a noteworthy trend of increasing institutional confidence. Following its acquisition under the CIRP, the promoter, Dhanuka Laboratories, was required by regulations to dilute its stake to meet minimum public shareholding norms. A key transaction in this regard took place on November 28, 2023, when Dhanuka Laboratories sold 13 lakh equity shares, equivalent to a 2.56% stake, through an open market transaction.

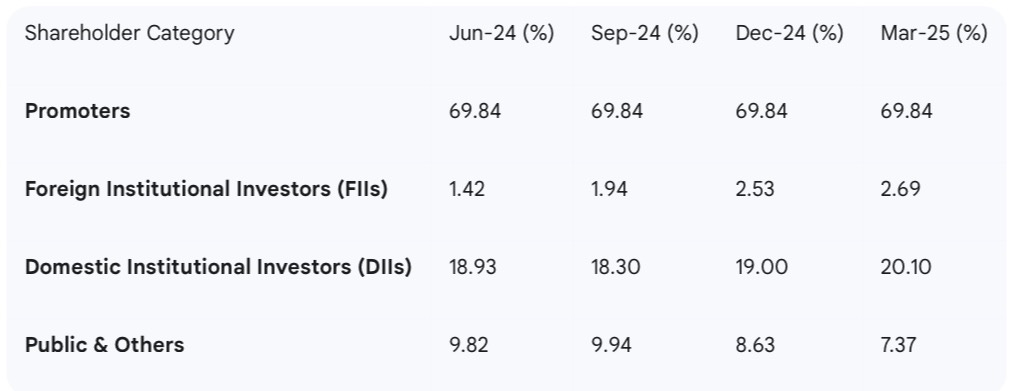

Crucially, this supply was absorbed by sophisticated institutional investors. On the same day, UTI Mutual Fund was a prominent buyer, acquiring 4.45 lakh shares. This is part of a broader trend of institutional accumulation. The data shows a clear shift in ownership, with institutional investors increasing their stake while the promoter holding has been gradually reduced to comply with regulations.

The following table, based on data from analyst reports, illustrates this trend over the quarters of fiscal year 2025.

This "changing of hands" narrative provides a powerful signal of market validation. The promoter's stake sale is a technical requirement, not a reflection of diminishing confidence. The fact that this supply has been readily absorbed by discerning domestic and foreign institutions indicates that "smart money" views the company's long-term prospects favorably. This institutional buying, occurring against the backdrop of a clean regulatory report from the USFDA and the unfolding of the company's strategic growth plans, serves as a strong external vote of confidence in the management's vision and its ability to execute it.

Synthesis and Outlook: An Objective Assessment of Growth Triggers

A comprehensive review of Orchid Pharma's exchange filings over the last year reveals a company in the midst of a carefully orchestrated, multi-year transformation. The narrative is not one of incremental improvement but of a strategic repositioning for significant, long-term growth. The analysis has identified four distinct but interconnected growth levers that form the pillars of the company's future. However, these powerful catalysts are balanced by material risks and execution timelines that place the most significant impact further in the future.

The primary growth triggers are clear and potent. First, the strategic consolidation through the amalgamation with Dhanuka Laboratories is set to create a Cephalosporin powerhouse with enhanced scale, a more diversified product portfolio, and significant operational synergies. Second, the potential for

R&D monetization from the NCE Enmetazobactam and other pipeline assets like Cefiderocol represents a non-linear value creation opportunity, targeting the high-need AMR space. Third, the tangible

margin expansion expected from the backward integration into 7-ACA manufacturing under the PLI scheme promises to fortify the core business and improve profitability sustainably. Finally, these internal strategies are underpinned by strong external

market validation, evidenced by a clean regulatory bill of health from the USFDA and growing ownership by institutional investors.

However, a prudent assessment must weigh these potential upsides against the significant headwinds and risks that have also been disclosed. The outlook for the immediate future, particularly FY26, appears muted. Management and analysts have highlighted persistent demand and pricing pressure in the company's base API business, which is likely to constrain near-term revenue growth and profitability. This is compounded by the uncertainty surrounding the Enmetazobactam royalty stream due to the Allecra Therapeutics bankruptcy, which removes a key near-term earnings driver. Furthermore, the company is making upfront investments in its new Orchid Antimicrobial Solutions (AMS) division, which will likely be a drag on profitability before it starts generating meaningful revenue.

The growth story is, therefore, heavily back-ended. The true inflection point for Orchid Pharma's earnings and valuation is contingent on events expected to unfold in the medium-to-long term (FY27-FY28). The realization of the company's full potential depends critically on the successful resolution of the Allecra bankruptcy, which would unlock the Enmetazobactam royalty stream, and the timely commissioning and ramp-up of the 7-ACA and Cefiderocol projects, whose financial contributions have been delayed.

In final consideration, the exchange filings from the past year unequivocally indicate the presence of multiple, powerful, and potentially transformative growth triggers for Orchid Pharma. The management has laid out a clear and ambitious roadmap for growth through consolidation, innovation, and strategic investment. The triggers are credible. Yet, the analysis also reveals that the path to realizing this growth is subject to material execution risks and external dependencies that have pushed the timeline for fruition further into the future. Therefore, while the filings do present a compelling long-term growth narrative, it is one that demands patience and a clear-eyed understanding of the associated risks. The catalysts for a fundamental re-rating of the company are in place, but their full impact is not imminent.